How do I report cryptocurrency on my taxes? This form comes with easy-to-follow instructions and requires you to only include new or updated information.

#Turbotax 1040x amendment download

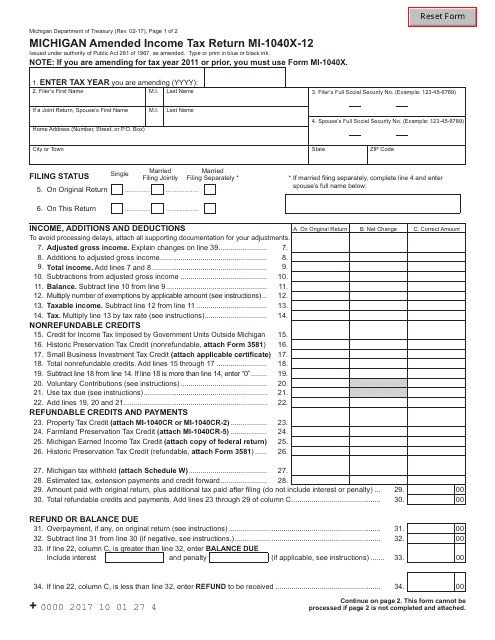

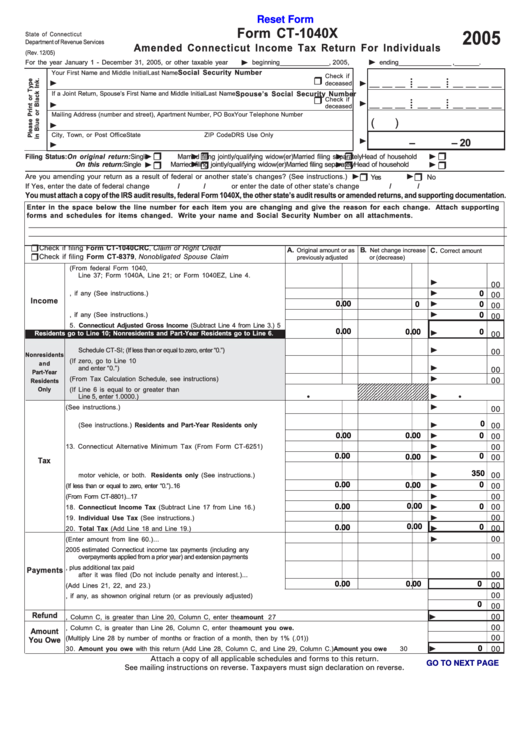

Once you have determined your tax liability, you should download a current IRS Form 1040X, Amended U.S. Just connect your wallets and exchanges and let the platform generate a complete tax return in minutes! Step 2: Complete Form 1040X

#Turbotax 1040x amendment software

If you're having trouble calculating your tax bill, crypto tax software can help. To do this, you’ll need accurate records of your cryptocurrency disposals and income events. To calculate your tax bill, you’ll need to calculate your capital gains and income from cryptocurrency during the tax year. The first step to submitting an amended tax return is figuring out your tax liability. Step 3: Mail or e-file your amended tax return Step 1: Calculate your tax liability If you’ve forgotten to report cryptocurrency on your taxes, you can follow this 3-step process to submit an amended tax return. However, the IRS is known to be more lenient to those who make a good-faith effort to properly pay their taxes. Some investors fear that submitting an amended return may increase their risk of a future audit. You have three years from the date that you filed your return to file an amended return. What should you do if you already filed your tax return, but you forgot–or didn’t know you had to–report your cryptocurrency gains on that return? The best idea is to amend your tax return from whichever year(s) you didn’t include your crypto trades. What should I do if I forgot to report my crypto taxes in the past? In the past, the agency has worked with contractors like Chainalysis to analyze blockchain transactions and identify ‘anonymous’ wallets. Figuring out an individual’s activities on that ledger essentially comes down to associating a wallet address with a name. It’s important to keep in mind that blockchains are distributed public ledgers, meaning anyone can view the ledger at any time. What happens if you don’t report cryptocurrency on your taxes? More infoFor more information, check out our guide to how cryptocurrency is taxed. You can't amend a return that hasn't been filed yet.

"First, make sure you really need to amend and that your 2017 return was accepted (or paper-filed) in TurboTax Online. This is what Turbotax help told me to do.

Please allow at least 16 weeks for the IRS to process your amended return. Three weeks after mailing your amended return, you can start tracking it at the IRS Where's My Amended Return? tracking tool. When finished, we'll give you instructions for printing and mailing your amended return, as amendments cannot be e-filed.

Carefully follow the onscreen instructions and don't worry if your refund changes to $0. Select Take me to my return, make your changes, and disregard the rest of these instructions.ģ. O If you only see the option to amend 2016 or earlier, it's because you can't amend an unfiled 2017 return. Under Your tax returns & documents, select Amend (change) 2017 return. O If you don't see this, select the menu icon in the upper-left corner to expand the menu.Ģ. Sign in to TurboTax and make sure you've selected Tax Home on the left side of your screen. You can't amend a return that hasn't been filed yet.ġ. First, make sure you really need to amend and that your 2017 return was accepted (or paper-filed) in TurboTax Online.

0 kommentar(er)

0 kommentar(er)